Bridge Crypto: Overview BMI Tocken

Bridge Mutual is a permission-less, decentralized, and DAO-managed discretionary risk

coverage platform that provides coverage for smart contracts, stablecoins, centralized exchanges, and

other services. The platform allows users to purchase coverage for their funds, provide coverage in

exchange for profits and yield, vote on policy claims and their payouts, and receive compensation for

assessing claims fairly.

Bridge Mutual allows any person to create and provide liquidity for coverage

pools for any smart contract, exchange, or listed service at any time in exchange for a yield. Other

users can then purchase a coverage policy to “insure” themselves against hacks, rug pulls, or other

exploits that result in a permanent loss of funds.

Coverage for stablecoins, a different product within the platform, protects against

any loss of value caused by an event that de-pegs a stablecoin from its pair, usually one U.S. dollar.

Bridge Mutual will consist of thousands of coverage pools that represent coverage for every platform,

exchange, and stablecoin asset in the industry.

Some aspects of the Bridge Mutual business model have been altered or delayed to

speed up development time. Accordingly, there are features in v1.0 that will be improved or changed in

v2.0 and beyond. As we release newer versions of the platform, we will update this technical whitepaper.

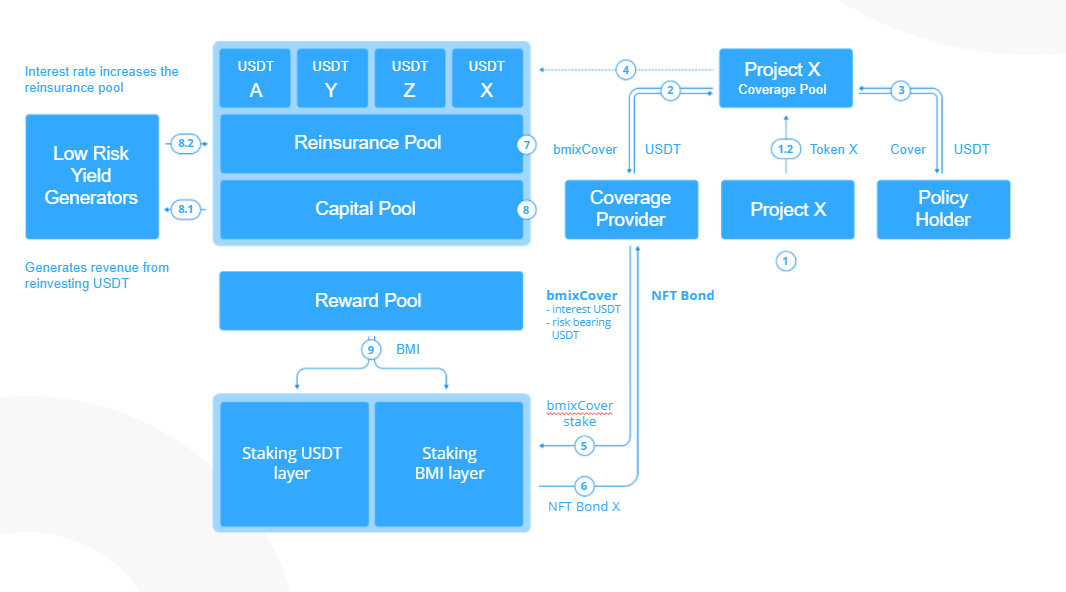

The various components of the model are marked as numbers and explained below.

-

Lorem ipsum dolor sit amet consectetur adipisicing elit. Accusantium expedita quo aliquid doloribus sint officia aliquam rem ex itaque assumenda totam laborum maxime illum, hic culpa quam in eligendi voluptates.

-

Lorem ipsum dolor sit amet consectetur adipisicing elit. Accusantium expedita quo aliquid doloribus sint officia aliquam rem ex itaque assumenda totam laborum maxime illum, hic culpa quam in eligendi voluptates.

-

Lorem ipsum dolor sit amet consectetur adipisicing elit. Accusantium expedita quo aliquid doloribus sint officia aliquam rem ex itaque assumenda totam laborum maxime illum, hic culpa quam in eligendi voluptates.

-

-

Lorem ipsum dolor sit amet consectetur, adipisicing elit. Tempora voluptates natus ipsam et, odit placeat excepturi adipisci maiores consequuntur modi sunt dolore corporis laudantium sapiente facilis ea repellendus dolores sequi!

-

Lorem ipsum dolor sit amet consectetur, adipisicing elit. Tempora voluptates natus ipsam et, odit placeat excepturi adipisci maiores consequuntur modi sunt dolore corporis laudantium sapiente facilis ea repellendus dolores sequi!

-

Lorem ipsum dolor sit amet consectetur, adipisicing elit. Tempora voluptates natus ipsam et, odit placeat excepturi adipisci maiores consequuntur modi sunt dolore corporis laudantium sapiente facilis ea repellendus dolores sequi!

-

Lorem ipsum dolor sit amet consectetur, adipisicing elit. Tempora voluptates natus ipsam et, odit placeat excepturi adipisci maiores consequuntur modi sunt dolore corporis laudantium sapiente facilis ea repellendus dolores sequi!

-

Lorem ipsum dolor sit amet consectetur, adipisicing elit. Tempora voluptates natus ipsam et, odit placeat excepturi adipisci maiores consequuntur modi sunt dolore corporis laudantium sapiente facilis ea repellendus dolores sequi!

-

Lorem ipsum dolor sit amet consectetur adipisicing elit. Voluptates, fuga.

-

Lorem ipsum dolor sit amet consectetur adipisicing elit. Voluptates, fuga.

-

-

Lorem ipsum dolor sit amet consectetur, adipisicing elit. Tempora voluptates natus ipsam et, odit placeat excepturi adipisci maiores consequuntur modi sunt dolore corporis laudantium sapiente facilis ea repellendus dolores sequi!

Exposure to riskier high-reward pools with attractive APYs.

Exposure to riskier high-reward pools with attractive APYs.